What Is The 45L Tax Credit?

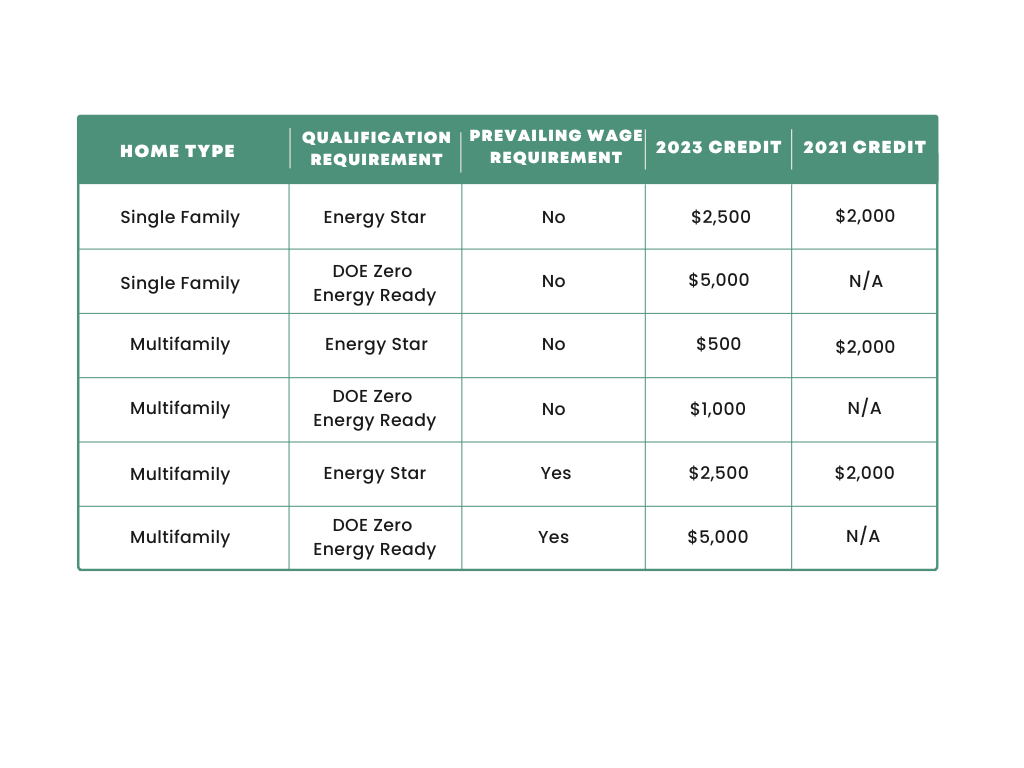

The energy efficient home credit, commonly known as the 45L, is a federal tax credit that provides eligible contractors up to $5,000 for each qualifying residential unit. Initially established by the Energy Policy Act of 2005, the 45L tax credit has been reinstated under new provisions of the Inflation Reduction Act to provide substantial incentives for builders to design and construct energy efficient residential buildings.

The Internal Revenue Code (IRC) Section §45L is a tax credit for each new energy-efficient home which is constructed by an eligible contractor and acquired by a person from the eligible contractor for use as a residence during the tax year. The credit can be taken on amended returns or carried forward up to 20 years. The IRS requires that a §45L analysis be conducted by a certified third-party using IRS-approved modeling software.

What Projects Qualify For The 45L Tax Credit?

To qualify for the 45L tax credit, a dwelling unit must be certified to be at least 50% more energy efficient than a similar unit constructed in accordance with the 2006 International Energy Conservation Code, with 10% being derived from building envelope component improvements.

Many types of residential projects qualify for the 45L tax credit, including:

- Single-family homes (custom & tract)

- Multi-family apartment and condominium projects 3-stories above grade and less

- Additional Dwelling Units (ADUs)

- Assisted living facilities & student housing

- Substantial reconstruction or rehabilitation

Who Benefits From the 45L Tax Credit?

The credit benefits the qualified builder or developer, directly, and indirectly benefits future owners and occupants of the housing through lower energy bills. The home must be sold, leased, or rented out to qualify for the 45L tax credit.

The 45L tax credit encourages builders to use energy-efficient construction materials. Some energy-efficient materials cost more, but the tax credit combined with increased equity in the construction project and lower energy bills for occupants have long-term benefits. Housing that’s certified can be marketed as “green living” and attract residents who are seeking housing that’s friendly to the environment as well as their budget. Buyers of certified units will also see increased equity as well as environmental and budgetary benefits.

Unused 45L tax credits may be carried forward for up to 20 years by the builder or developer.

How Do I Claim The 45L Tax Credit?

To file for the 45L tax credit, you must first obtain the necessary certifications to verify that the property meets all the above-mentioned standards of energy efficiency. These certifications must be obtained from an independent and qualified certifier, making use of the latest, IRS-approved software.

The certified assessing the property must be accredited by the Residential Energy Services Network (RESNET) or a similar rating network. However, you cannot certify a property that belongs to you or to a relative of yours, even if you are an authorized and qualified certifier in your own right. You must hire an independent expert who is not related to you in any way and can conduct the verification in an impartial manner.

Don’t miss out on potentially significant tax credits for your energy-efficient home construction project! The 45L tax credit helps contractors and developers build energy-efficient housing that’s more marketable, holds more value, and shields future residents from rising energy prices.

Energy Diagnostics has an extensive staff of RESNET accredited certifiers and energy modelers prepared to perform on-site inspection and verification services to determine if your property qualifies for the 45L tax credit. Contact us today to see if your project qualifies for $2,000-$5,000 per unit in energy-efficient tax credits.